2022-23 has been another chaotic year for both business & markets. For India it has been a story of valuation compression overshadowing earnings expansion. We expect another strong year for our portfolio companies & hope that this year valuations will expand to create a larger alpha. Since most of our companies are liberal on dividends thus portfolio yield is significantly high.

MACRO TRENDS

The Russia - Ukraine war has entered its 15th month or Day 432. It is ironic that this time last year the Euro came under severe pressure as questions were raised about EU's dependence on Russian gas & thus US Dollar gained against every other currency due to the TINA(There is no alternative) effect.

Ironically 2023-24 has started on the note that the world needs to find a replacement to the US Dollar. I am sure everyone has heard Uday Kotak calling the USD a 'financial terrorist'. How fast does the world change (or change its mind) is amazing. Thus we try to simplify macros to form a broad direction & then shift our focus to individual businesses. These trends will have some impact on our judgement when we deploy capital :-

- Defence spends have been doubled by most nations.

- Oil & gas have fallen sharply from peak levels despite OPEC cuts.

- Interest rates globally are close to peaking.

- US is slowing & USD is expected to be under pressure.

- China has finally reopened.

- India's inflation has been lower than that of US in the last 16 out of 18 months.

- India's credit growth has been upwards of 15%.

- Monsoons are expected to below normal

- FIIs are expected to favor 'emerging markets' over 'developed markets'

- Funding has dried for startups

MICRO STORY

The results for Q4 FY 23 have begun on a positive note.

We have given a TTM snapshot of the performance so far by our key holdings. On an average revenues have grown by 30% & EPS by 28% YOY which showcases the underlying strength of these businesses. Even ex of PVR which had a bump up due to the merger revenues have grown 18% & EPS 25% YOY. Since this will be available to the public thus valuations/ outlook have not been discussed.

Accelya Solutions India

- Revenues grew by 28% & EPS by ~60% on a TTM basis.

- Business is a proxy of the global airline industry which is yet to reach its pre covid levels.

ASIL is one of the few software companies to post such a solid performance this year. This is on the back of the travel industry reviving & will further get a boost from China reopening.

Axis Bank

- Revenues grew by 27% & EPS by 42% YOY post adjusting one offs

- Management is hopeful of growing at 20% CAGR for the next 5 years

Axis Bank's turnaround is visible in the numbers this year. The management change that took place 3 years ago & the silent efforts ever since have finally borne fruit. High CASA, solid tech stack & credit growth will aid this business.

Canara Bank

- Revenues grew by 16% & EPS grew by 60% YOY

- NPA recognition & provisioning are on the verge of completion after 7 years for this space & they trade at miniscule multiples to operational profits which has begun trickling down to PAT

A question often asked is will PSU banks get value ? PSU Banks were the top performing index for 2022-23. This year too we expect PSU banks to perform exceedingly well on every parameter. The EPS does not yet reflect the full potential of the franchise.

- Revenues grew by 2% & EPS grew by 11% YOY

- Credit growth has been above 15% for the last 6 month & thus rating revenue is expected to reflect this trend.

Crisil has posted a 16% growth in ratings business in Q4 FY23 & we expect CARE to do better. We expect this trend to continue for the next 4-5 years as corporates are presently at the lowest debt/ equity ratios in 2 decades. This business has significant operating leverage thus profit growth is much higher.

CESC Limited

- Revenues grew by 14% & EPS has fallen 2% YOY

- The focus is on distribution for CESC & they have won Chandigarh. Further an escalation the core Kolkata franchise is due.

This is the most reasonable play on the power distribution space & the management has calibrated growth plans for this vertical only. This will a big beneficiary of the Electricity Amendment Bill which will delicense the distribution business thus throwing up tremendous opportunities for efficient private players to compete against inefficient state PSUs. High dividends shield the holding cost & multiple triggers exist which could lead to rerating.

CSB Bank

- Revenues grew by 14% & EPS grew by 19% YOY

- CSB focuses on gold loans & is in the midst of a management change post takeover by Prem Watsa.

The management under Pronoy Mandal(ex HDFC, Yes) is building the tech stack for its retail play. In the interim the gold loan book is growing at ~45%. Gold loans are almost 50% of the book & in FY 24 they will have scope to grow the non gold business as well.

FDC Ltd

- Revenues grew by 13% & EPS was down 32%

- The company has increase marketing spends & thus the fruits of revenue growth will be visible at a later date.

Last year the company saw price erosion in an ophthalmic it was exporting to USA which was the prime reason behind this margin compression. The US market is expected to recover in FY 24 & the company has commissioned a new line for other export markets. NLEM price increase should see profitability improve going ahead.

GNFC Ltd

- Revenues grew by 41% & EPS by 29% YOY

- The management busted the myth of GNFC being just a TDI player. They indicated that the favorable pricing trend continues in Q4 & capacities are fungible to make use of the best spread.

The company has completed debottlenecking TDI where spreads are strong & is on track for another 1200 crore capex spend towards backward integration over the next year. This is equivalent to adding another 50% to the chemical fixed asset base which has asset turns of 2.5x & ROCEs of 35 - 75% depending on the pricing environment. Also the Gujarat government has formally conveyed all PSUs to pay minimum 30% of PAT as dividend & distribute cash above 1000 crores as dividend or buyback. This should create significant value.

Matrimony.Com

- Revenues grew by 6% & EPS fell by 10% YOY

- Marketing spends & competitive intensity amongst the three players remains high.

The thesis has not played out & no additions have been made this year in this name. We have partially exited this position.

MSTC Limited

- Revenues fell by 27% as platform business has replaced trading business & EPS grew by 46 % YOY

- Auction of Coal, Iron Ore, Bank NPAs are now gaining traction besides scrap.

Being a PSU is a massive advantage as it evokes a feeling of 'trust & transparency'. No questions are raised on any official for using this platform. Even private players are now approaching MSTC for multiple requirements. Further the company has launched a platform for End of Life Vehicles(ELVs) which has gained significant transaction & is getting popular amongst retail users.

Monte Carlo Fashions

- Revenues grew by 23% & EPS grew by 29% YOY

- Company continues to build both online & offline distribution. The sales mix is migrating to cotton thus overcoming seasonality.

The company has implemented SAP based ERP which is one of the most advanced for this trade. Being focussed on the domestic market will help them survive the US slowdown.

Prestige Estates

- Pre-Sales grew by 25% & Cash collections grew by 31%

- The company has delivered better than its guidance by 1000 crores to touch almost 13,000 crores & Mumbai contributed ~2700 crores.

Real Estate accounting is complex as the regulator allows sales to be booked on P&L only after completion certificate is received. This camouflages the real sales that happens for the larger part of the project life. Prestige is a strong brand & manages to sell a large part of its inventory at launch or within a year of launch. Thus a better picture emerges out of pre-sales & balance sheet rather than the P&L statement. Mumbai should do even better this year & Bangalore has seen pricing move up as inventory has dried.

PVR Inox

- Revenues grew by 223% & EPS grew by 84% YOY due to the impact of the merger

- Covid ensured a regulatory window for these two players to merge without shutting a single screen & thus creating a monopoly which commands more than 50% of theatrical revenues

While OTT is definitely a challenge yet theatre remains one of the cheapest & most practical form of entertainment for the Indian diaspora. Given the hot weather an air conditioned indoor escape like a multiplex will always be preferred. This behemoth will have power to price, negotiate for content, rental & advertisements like never before.

Raymond Ltd

- Revenues grew by 44% & EPS grew by 128% YOY

- The company is simplifying the complex conglomerate structure & creating separate entities for every business.

They have sold the consumer business at a good valuation to Godrej & will be repaying the debt on the lifestyle business. Thereafter real estate & lifestyle will be a separate listed entity each. Give the succession challenges we think they will divest the other businesses as well in due course of time.

Sarda Energy

- Revenues grew by 18% & EPS fell by 6% YOY

- A long gestation capex of hydel power & commencement of Gare Palma coal mine has added linearity to the revenue stream.

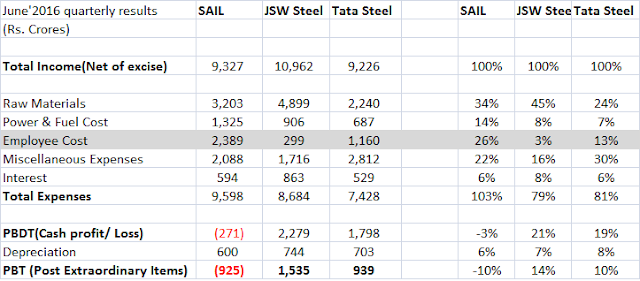

- For SAIL, TATA Steel & GPIL profit fell by 76%, 53% & 33%. Sarda has seen the same fall by 6% only which shows the robustness of the business model & far sightedness of the management.

Sarda continued with its expansion in the low interest regime & has emerged out of Covid by tripling its fixed asset base. The debt repayment cycle has begun but not at the expense of capex as was the case with some peers.

Saregama India

- Revenues grew by 38% & EPS by 33% YOY

- Management is hopeful of growing at 20% CAGR for the next 5 years

The music business has seen a transformation with the advent of legitimate streaming platforms, short video apps & bluetooth speakers. Creating content is a costly & long drawn affair thus those sitting on a library have become big beneficiaries. Saregama already has India's largest catalogue of 135,000 songs, further they are acquiring content & have added a 1700 song catalogue in Telgu. The larger the player the better the pricing it can negotiate from platforms & Saregama is playing this game well. In the music appliance(Carvaan) business multiple variants of Carvaan are Amazon Bestsellers / Amazon Choice. The newly launched soundbar is being recommended by dealers thus another interesting business being nurtured.

TIPS Industries

- Revenues grew by 31% & EPS by 13% YOY

- Management has signed content sharing deals with new platforms & still has scope to add many more.

Besides Saregama the only other listed play on music streaming, Tips has completed the demerger. The movie vertical has been carved out & listed separately where we have taken partial exit.

TV Today - Revenues are flat YOY & EPS fell by 35% YOY

- The company has paid a special dividend of Rs. 67.

While the digital business continues to grow yet the pace & realization are not as per expectation. Visibility of platforms compensating for news content is still not clear & competitive intensity is strong. We have thus not added to this position.

Disclaimer : We have reviewed the performance of some of our key holdings. Some names where we are presently building position & liquidity is a challenge have been excluded for obvious reasons. Every advice offered is different & constitutes stocks based on the then prevailing scenario. Thus do not construe this as a buy or sell advice and the present recommendations might or might not include the names above.

Comments

Post a Comment