It's not SAIL-ing, It's sinking

SAIL in particular & steel in general have never piqued my interest. Coincidentally I was watching CNBC when the numbers for SAIL were being flashed & was quite surprised to see a loss. Despite the slowdown in steel, I remember SAIL as an integrated player with the best mines & state of the art plant. I could not fathom any reason why the company was a loss making unit & when I asked some seasoned steel investors - their guess was interest/ depreciation on account of an ongoing capex which made me wonder at the size of capex & thus I delved deeper.

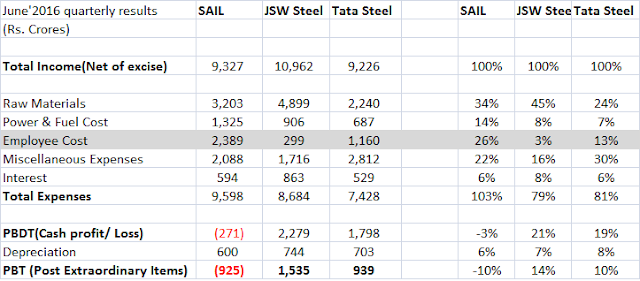

Here is a comparison for SAIL, Tata Steel(domestic) & JSW Steel for the last quarter. These companies are almost identical in size thus comparison is quite easy.

These quarterly numbers have no aberrations. Many inferences to draw but the most interesting one is on the employee cost, that is the problem.

=> SAIL's employee cost is 8 times that of JSW Steel while their operations are sized the same. It is double that of Tata Steel.

=> SAIL has ~95000 employees (150,000 in 2003) vs 36000 for Tata Steel India & 11000 for JSW. => This is despite the company shedding nearly 30% workforce over the last decade mainly during the slowdown of 2002-03 before the lengthy upturn in the cycle.

SAIL is sinking as it has too many employees on board, probably overweight(read: overpaid). Infact this is not just SAIL's problem, it is valid across PSU companies & infact some old private sector companies also face this legacy issue. Even Tata Steel has a wage bill of 4 times that of JSW steel. NALCO has the same employee cost as Hindalco despite revenues being just 25% of Hindalco.

This problem is even bigger in the West & has been aggravated by benefits such as Pension, Health etc., infact pension liabilities of many firms today are higher than their networth. The unfunded pension liability of US states is being pegged at USD 1.75 trillion as per Moody. It is extremely difficult to solve this in a democracy where a dirty muddle of labor rights, unions & vote bank has been created. Thus an irreversible trend of outsourcing(not offshoring) entire departments has picked pace.

This specialized aspect of outsourcing is - Managed services. For example, if you have applied for a Schengen visa recently then instead of an embassy you must have visited the center managed by VFS. Many such functions are being outsourced by the European & North American public sector firms.

We have noticed that one of our holdings Hinduja Global is tasting success in this domain. They have a physical presence in 7 European Locations & 21 North American locations which gives them an edge & the backup of another 40 centers in India & Philippines help control costs. This opportunity has been discussed in their annual report & Q1 result interview and is now visible in their numbers. In the last two quarters the company has done an EPS of Rs. 45 as compared to Rs. 49 for full year FY16 thus available at a PE of 6x. The cash EPS for 6 months is at Rs. 80 thus trading at 3.5x its cash flows. The market attributes premium valuations to Quess Corp & Team Lease trading at a PE of 60-80X who in some form play a role in this space. HGS has similar management pedigree & thus is an interesting study.

Here is a comparison for SAIL, Tata Steel(domestic) & JSW Steel for the last quarter. These companies are almost identical in size thus comparison is quite easy.

These quarterly numbers have no aberrations. Many inferences to draw but the most interesting one is on the employee cost, that is the problem.

=> SAIL's employee cost is 8 times that of JSW Steel while their operations are sized the same. It is double that of Tata Steel.

=> SAIL has ~95000 employees (150,000 in 2003) vs 36000 for Tata Steel India & 11000 for JSW. => This is despite the company shedding nearly 30% workforce over the last decade mainly during the slowdown of 2002-03 before the lengthy upturn in the cycle.

SAIL is sinking as it has too many employees on board, probably overweight(read: overpaid). Infact this is not just SAIL's problem, it is valid across PSU companies & infact some old private sector companies also face this legacy issue. Even Tata Steel has a wage bill of 4 times that of JSW steel. NALCO has the same employee cost as Hindalco despite revenues being just 25% of Hindalco.

This problem is even bigger in the West & has been aggravated by benefits such as Pension, Health etc., infact pension liabilities of many firms today are higher than their networth. The unfunded pension liability of US states is being pegged at USD 1.75 trillion as per Moody. It is extremely difficult to solve this in a democracy where a dirty muddle of labor rights, unions & vote bank has been created. Thus an irreversible trend of outsourcing(not offshoring) entire departments has picked pace.

This specialized aspect of outsourcing is - Managed services. For example, if you have applied for a Schengen visa recently then instead of an embassy you must have visited the center managed by VFS. Many such functions are being outsourced by the European & North American public sector firms.

We have noticed that one of our holdings Hinduja Global is tasting success in this domain. They have a physical presence in 7 European Locations & 21 North American locations which gives them an edge & the backup of another 40 centers in India & Philippines help control costs. This opportunity has been discussed in their annual report & Q1 result interview and is now visible in their numbers. In the last two quarters the company has done an EPS of Rs. 45 as compared to Rs. 49 for full year FY16 thus available at a PE of 6x. The cash EPS for 6 months is at Rs. 80 thus trading at 3.5x its cash flows. The market attributes premium valuations to Quess Corp & Team Lease trading at a PE of 60-80X who in some form play a role in this space. HGS has similar management pedigree & thus is an interesting study.

I also noticed that they have renegotiated the Canadian deal which will work out favourable and the collibrium accusation will improve there high margin health care vertical hope this fy they try to reduce the debt and trade receivable

ReplyDeleteAlso since you are searching for value stocks kindly have a look at the sandesh ltd.

Thanks, I like Sandesh.

Deletevery nice maan ji (using the name bcos it seems u dont like mentioning sir).Please keep posting more.Budding (investors) like us need people like u.Are you on twitter.Any good book for investing for mid level person please.

ReplyDeleteThank you. I remember 'One up on wall street' as one of the first investment books that I liked. It's a good start, the list is never ending thereafter.

Deletehi maanji, in view of recent developments, would like to know if any changes in your view on tata motors? r u still positive on it?

ReplyDeletethanx in advance..

The view remains the same. JLR is independently run & largely insulated from the management tussle. The product pipeline remains strong & the company benefits operationally from a weak pound. My sense is hedging losses will not be visible in December numbers. JLR is protected from demonetisation & that will start reflecting in the prices soon.

DeleteAlso, one more query. As the real estate sector will be affected by the recent demonetisation, will DHFL also suffer? or will it just be a temporary problem for DHFL?

ReplyDeleteThe temporary challenge will be on slippages & demand erosion. This will correct in 3-6 months.

DeleteThe longer term challenge is competition with banks flushed with liquidity. Valuations for Dewan is anyways not pricing growth so am not concerned specifically on Dewan.

thanx very much for the reply maanji..

ReplyDeleteMoney will not bring you happiness, but its better rather cry in a mecedes than in a bus. capitalstars Financial Research Private Limited.

ReplyDelete