To hit a six, get your timing right !

The India- Australia series has just begun & Pujara has scored a century to save India some serious blushes. He hit a six to get into the nineties & was lucky to get away with it. The link has the shot at 1 .25 (https://www.cricket.com.au/video/cheteshwar-pujara-century-milestone-innings-australia-india-first-test-highlights-adelaide-oval/2018-12-06). He has the best temperament but definitely lacks on timing thus missing out on ODI, T20 & serious endorsement money. In markets too, a lack of timing can be costly.

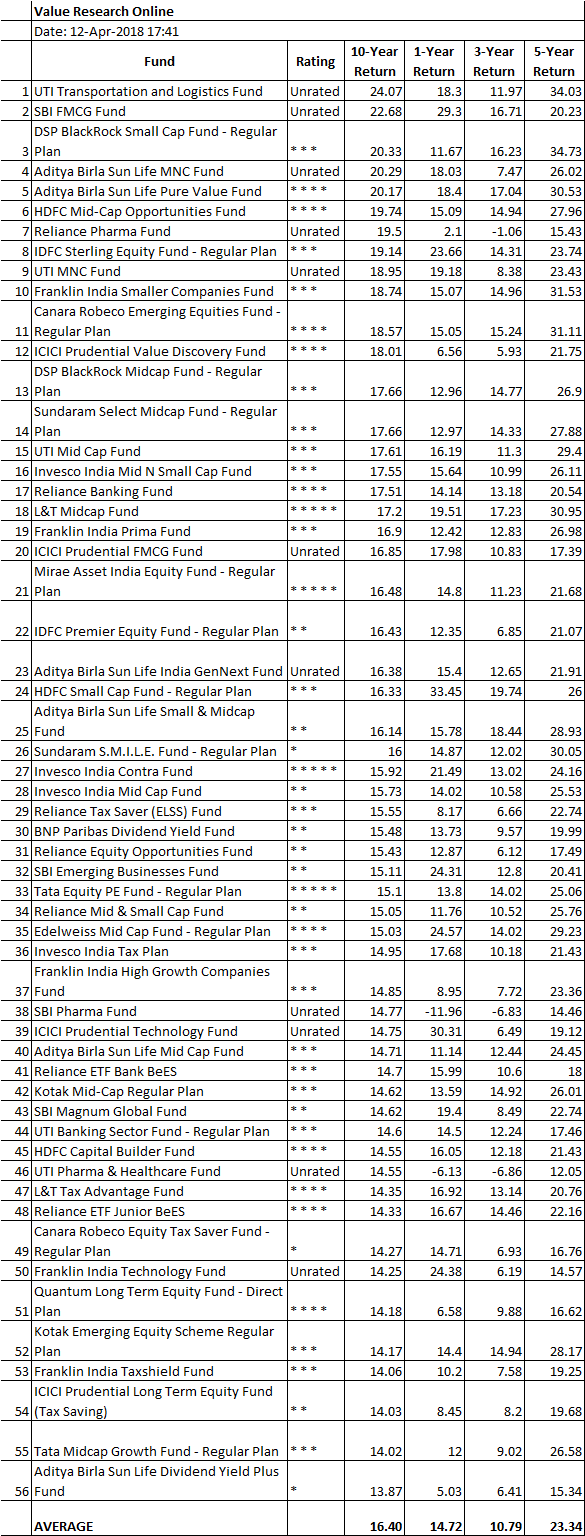

On every interview by any money manager, I always hear this quote "Time in the market, not market timing". It's heard often when markets are close to their peaks & the manager has no justification for the valuation or rationale of staying invested. The manager will urge you to take a longer term view & ignore any near term corrections. It's difficult to dispute the view as getting the timing right is actually quite rare. But here is some data on the top 56 funds based on 10 year CAGR in April 2018:-

December 2008 was post Lehman crisis & April 2008 was pre Lehman crisis. The beginning for both cycles made all the difference.

On every interview by any money manager, I always hear this quote "Time in the market, not market timing". It's heard often when markets are close to their peaks & the manager has no justification for the valuation or rationale of staying invested. The manager will urge you to take a longer term view & ignore any near term corrections. It's difficult to dispute the view as getting the timing right is actually quite rare. But here is some data on the top 56 funds based on 10 year CAGR in April 2018:-

- Only 5 funds have delivered returns in excess of 20% CAGR over 10 years.

- This despite strong 5 year performance on an average & positive 1 year performance.

Let us now look at data in December 2018.

- 56 funds have delivered returns in excess of 20% CAGR as compared to 5 in April

- From April to now the average correction has been ~20% yet 10 year performance has improved.

Infact look at the average performances of these two sets :-

- 10 year out-performance in December is almost 6% CAGR, which is huge over 10 years.

- The out-performance in December comes despite negative 1 year returns, lower 3 year returns & lower 5 year returns. - WHY ?

December 2008 was post Lehman crisis & April 2008 was pre Lehman crisis. The beginning for both cycles made all the difference.

- Thus a long term investor who would have entered in April would on an average make a decent return of 16% CAGR over10 years if he had been in the top 56 funds.

- An investor who was bold & stepped in during the crisis would generate a spectacular return of 22% CAGR for 10 years that too after seeing a massive correction in 2018.

- Investments made during a crisis deliver a great alpha over the longer run.

- Thus if you see the present situation as a crisis, you should be building a long term position in the market, that would be great Timing.

P.S - This data is for the top 56 funds over 10 years. There are over 800 funds & thus fund selection is just as important. Kindly rely on an adviser for your assessment to choose the right fund or build the right portfolio.

Perfect to the point Analysis..Thank you Maan for great energy booster.

ReplyDeleteGreat analysis

ReplyDelete