It's Grass on Clay

The French Open has eluded many greats - Sampras, McEnroe, Connors, Edberg, Becker & even the ladies like Hingis & Venus. It's the only title of importance that's missing on their resume.

Djokovic won last year in his 12th attempt but such was the pressure that he has not come close to winning at a grand slam since despite winning everything prior to that. Ironically he just lost to Thiem in straight sets going down 6-0 in the final set to a player he has never lost to before.

Djokovic won last year in his 12th attempt but such was the pressure that he has not come close to winning at a grand slam since despite winning everything prior to that. Ironically he just lost to Thiem in straight sets going down 6-0 in the final set to a player he has never lost to before.

Even the great Federer decided to skip the slam this year despite being in top form & winning almost everything earlier. The reason cited by him & his team was the preparation required on clay was different. (I'll come back to preparation) Clay is a tricky surface indeed.

I wonder what another Federer - Nadal final at Roland Garros would be like. Federer fans (including me) would hope that 'clay plays like grass' for just this one night that would probably be Federer's best shot but nothing could be worse. Beyond a point it's 'preparation' both mental & physical that makes all the difference. If he has prepared for clay then he would be terrible on grass, a surface he prefers. At this level even improvisations have to be rehearsed, the room for error is so little & skill levels so high that rarely can a massive change in conditions be digested. Irrespective of who wins, it would be a terrible match to watch as both would be playing significantly below par.

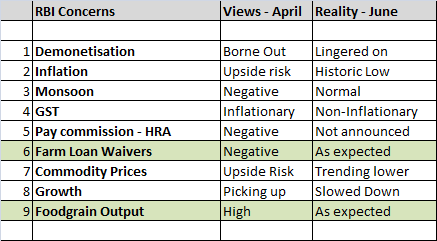

Oddly, Urijit Patel led RBI is facing this very situation. They have been preparing for clay when the game is on grass. Their performance is dismal & needless to say embarrassing. Let alone estimates, even direction seems to be going wrong. Here is a table comparing their key estimates in April when they became 'neutral from accommodating' :-

These are the views expressed & terms used in the official statement for key issues in April & June. Their assessment played out correctly only for 2 out of 9 important issues. On 6 they were completely wrong. As with all intellectuals put on a pedestal, they seldom fail to understand that they have got it wrong until its too late (Merton - Scholes & Long term Capital is a classic example). Here is RBI's confused assessment of themselves not the situation

"The abrupt and significant retreat of inflation in April from the firming trajectory that was developing in February and March has raised several issues that have to be factored into the inflation projections. First, it needs to be assessed as to whether or not the unusually low momentum in the reading for April will endure. "

Thus instead of being pleased at positive results on the fight against inflation, they are more concerned about their pathetic view which sounds more like "we did not predict it would end, so lets call this abrupt". They still have not assessed the nature of inflation while the indicators are obvious :-

1) Wage hike by Wipro is 5% & Infosys has defered it to July. On a generalized basis this article depicts the ground reality for wages & its impact on inflationary expectation.

http://www.hindustantimes.com/business-news/the-ever-slowing-salary-hikes-at-indian-companies-new-survey-shows-drop-over-past-decade/story-8lJ07FubCbb2I30rmdQfgP.html

2) Crude has corrected another 5% post the release further denting any worries on commodity led inflation.

3) Currency has strengthened which has put a check on imported inflation.

4) Slow growth & low capacity utilization across industries further diminishes demand led inflationary risks.

5) GST is now being touted as anti inflationary.

6) Food stocks are at record highs & thus the most painful aspect of inflation is under control.

7) Real Estate has no pricing power, infact transactions are stuck as real rates are lower than circle rates. Earlier buyers would pay in black, now the sellers might reimburse in black.

RBI seems to be affected by some biases when inflation was sticky & any fall in inflation would be very temporary. The lack of understanding is evident as they are looking for data to justify their thesis & not the other way round where data should form the basis of view. Let's hope they smell the grass soon else we'll keep walking slowly on a surface meant for a faster play.

1) Wage hike by Wipro is 5% & Infosys has defered it to July. On a generalized basis this article depicts the ground reality for wages & its impact on inflationary expectation.

http://www.hindustantimes.com/business-news/the-ever-slowing-salary-hikes-at-indian-companies-new-survey-shows-drop-over-past-decade/story-8lJ07FubCbb2I30rmdQfgP.html

2) Crude has corrected another 5% post the release further denting any worries on commodity led inflation.

3) Currency has strengthened which has put a check on imported inflation.

4) Slow growth & low capacity utilization across industries further diminishes demand led inflationary risks.

5) GST is now being touted as anti inflationary.

6) Food stocks are at record highs & thus the most painful aspect of inflation is under control.

7) Real Estate has no pricing power, infact transactions are stuck as real rates are lower than circle rates. Earlier buyers would pay in black, now the sellers might reimburse in black.

RBI seems to be affected by some biases when inflation was sticky & any fall in inflation would be very temporary. The lack of understanding is evident as they are looking for data to justify their thesis & not the other way round where data should form the basis of view. Let's hope they smell the grass soon else we'll keep walking slowly on a surface meant for a faster play.

Nice article, well written....thanx..

ReplyDelete• IndusInd Bank raises a USD 225 million loan from OPIC for its MSME lending program

ReplyDelete• Repco Home Finance proposes to raise Rs 100 crore by issuing non-convertible debentures (NCDs)

CapitalStars

Thank You for informative information

ReplyDeleteNever think about beauty of trading making money is more important CapitalStars