Being Human .. Just not to bankers

Off late the number of mergers & demergers have increased manifold. The textbook rationale for a merger is synergy & that for a demerger is focus.

Calcutta based Dhunseri group (Dhunseri Petchem & Dhunseri Tea) has the odd distinction of using both rationales in a span of 5 years. Surely the textbook intent & what the Dhunseri management actually wanted was very different. After merging everything in 2009, the second act of demerger initiated in 2014 was driven by survival instincts. While I wont get into details, this was a red flag for any stakeholder as the company abruptly chose to undergo such a tedious exercise again. Leverage & the Egypt expansion was poised to bankrupt the group. There was extreme volatility but the 'loyal' stakeholders have not suffered permanent erosion (not yet at least), thanks to crude & a strategic investor coming on board.

Another demerger which piqued my interest was of Mandhana Industries. But first here is a history of Mandhana Industries (as I see it) :-

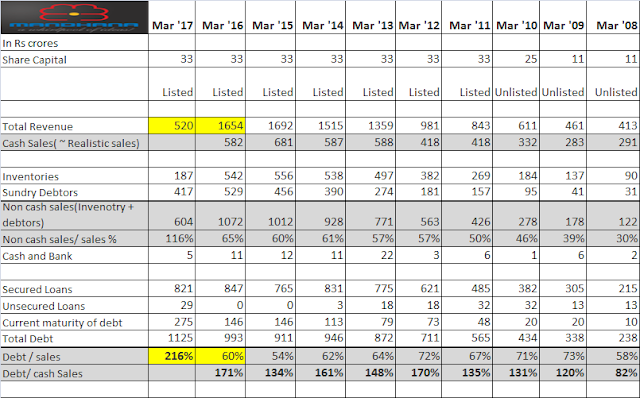

To their credit while shallow as businessmen, Mandhana's had mastered the art of duping stakeholders. In 2014 they announced the demerger of that portion of business which was profitable. What is surprising is how blunt they have been about misusing the system & yet they have escaped the stick. Tables tell quite a tale :-

Mandhana's as their logo suggests had a 'whirlpool of ideas' when going in for the demerger. It was quite simple actually, to carve out the business that is working on a debt free basis & continue doctoring books till then. Thereafter if further funds are not available, default & let the world know. .

On 29th March 2016 they received their approval for merger from the High Court & on 31st March'2016 they had defaulted on payments to various banks. Thereafter not only have they defaulted on every payment but one can see the actual revenue in 2017 & the nature of business & assets that the banks have to now dispose. It is surprising that the banks have been duped in such a simple manner.

Another table of what the banks have agreed to let go off, the demerged business now 'The Mandhana Retail Ventures Ltd' ironically the owner of Being Human:-

TMRVL was listed at a valuation of ~ 500 crores & even presently enjoys a market cap of 300 crores. It is at a discount to peers on almost all metrics & is growing reasonably well.

Equity investors have seen a wealth erosion of ~70% from peaks, saved by TMRVL demerger. At this juncture TMRVL seems to be making the right 'noises' to please them :-

However, give the track record of the management of gaming the system one would not bet the house on this one. It would be interesting if IDBI finds a strategic buyer for its stake & the Mandhana name finds its way into the companies history.

Calcutta based Dhunseri group (Dhunseri Petchem & Dhunseri Tea) has the odd distinction of using both rationales in a span of 5 years. Surely the textbook intent & what the Dhunseri management actually wanted was very different. After merging everything in 2009, the second act of demerger initiated in 2014 was driven by survival instincts. While I wont get into details, this was a red flag for any stakeholder as the company abruptly chose to undergo such a tedious exercise again. Leverage & the Egypt expansion was poised to bankrupt the group. There was extreme volatility but the 'loyal' stakeholders have not suffered permanent erosion (not yet at least), thanks to crude & a strategic investor coming on board.

Another demerger which piqued my interest was of Mandhana Industries. But first here is a history of Mandhana Industries (as I see it) :-

- The company came out with its public issue hiring the likes of Edelweiss & Axis as their flagbearers in April'2010 for an IPO at 120-130.

- At this stage their non cash sales was at 50% & debt was higher than cash sales. Despite the IPO their bank/ cash equivalents were at 6 crores in FY 11 such was the burn.

- Thereafter non cash sales kept rising as a percentage to sales, infact growth in sales was largely driven by debtors/inventories.

- Somehow the bankers were never worried, lead by the likes of Allahabad, BOB, PNB, Corporation Bank, State Bank of Saurashtra, Axis, Karur Vysya, Indian Bank, L& T Finance(debentures with trusteeship of IDBI) have now a joint exposure of ~1100 crores. Non bank loans stand at ~28 crores. The generosity of our public sector banks has never been in doubt but to be fleeced in such an obvious manner is quite a surprise.

- The demerger was approved by the courts on 29th March 2016 & in March 2017 itself real numbers are disclosed which are close to cash sales

- The key metrics like debt/sales in 2017 inch closer to what would have been had one considered cash sales only.

Mandhana's as their logo suggests had a 'whirlpool of ideas' when going in for the demerger. It was quite simple actually, to carve out the business that is working on a debt free basis & continue doctoring books till then. Thereafter if further funds are not available, default & let the world know. .

On 29th March 2016 they received their approval for merger from the High Court & on 31st March'2016 they had defaulted on payments to various banks. Thereafter not only have they defaulted on every payment but one can see the actual revenue in 2017 & the nature of business & assets that the banks have to now dispose. It is surprising that the banks have been duped in such a simple manner.

Another table of what the banks have agreed to let go off, the demerged business now 'The Mandhana Retail Ventures Ltd' ironically the owner of Being Human:-

TMRVL was listed at a valuation of ~ 500 crores & even presently enjoys a market cap of 300 crores. It is at a discount to peers on almost all metrics & is growing reasonably well.

- Bank debt of only 2 crores was transferred to this entity belonging to Axis Bank.

- Promoter debt of 5 crores was transferred which was repaid by taking a loan of 5 crores from HDFC Bank which is willing to take an exposure in the demerged entity.

- Banks oddly agreed to pass this asset of in totality & merely half of the promoter holding lies pledged to debenture holders.

- The only solace that the concerned banks could probably have is that the promoter might end up as a minority as all but ~15% holding is pledged to IDBI(debenture trustee), but who knows with their 'whirlpool of ideas' & the cooperative nature of our PSU banks we could see Mandhana's driving away with this one too.

Equity investors have seen a wealth erosion of ~70% from peaks, saved by TMRVL demerger. At this juncture TMRVL seems to be making the right 'noises' to please them :-

- Rakesh Jhunjhunwala was bought in as a strategic investor with ~13% stake & a board seat

- A reputed auditor was appointed

- Rumors of Salman Khan Foundation pulling the plug were dispelled

- Store expansion has been at good pace & is visible on ground

However, give the track record of the management of gaming the system one would not bet the house on this one. It would be interesting if IDBI finds a strategic buyer for its stake & the Mandhana name finds its way into the companies history.

Thanks for sharing such a great and wonderful post Fantastic, full of informative information you are providing really nice information.Great Work.

ReplyDeleteForex Tips

I am really enjoying the theme/design of your web site. Do you ever run into any browser compatibility issues? A couple of my blog visitors have complained about my website not operating correctly in Explorer but looks great in Opera. Do you have any tips to help fix this problem? Foreigners Buying Real Estate In Us

ReplyDeleteI and my pals were reading through the nice suggestions found on the blog while instantly I got a terrible feeling I never thanked the blog owner for those secrets. Those ladies were as a consequence thrilled to learn them and have now in truth been taking pleasure in them. Thanks for getting well accommodating and also for finding this form of nice subjects most people are really eager to understand about. Our own sincere apologies for not saying thanks to you sooner. very discount codes

ReplyDeleteThe market is the vast array of investors and traders who buy and sell the stock, pushing the price up or down for share tips click. Share Tips

ReplyDelete