The Crash of Cash

On November 8th PM Modi etched a new word in the Financial Hall of Fame - DEMONETIZATION.

This move meant that currency equivalent to 15.4 Lakh Crores would have to be deposited in a bank account. To put the size in context this is equivalent to 11-13% of our GDP. A paltry 3-4 lakh crores will be exchanged/ withdrawn as cash (given the limits imposed), the rest will find its way into one bank or the other, if not RBI/ Govt balance sheet stands to benefit.

While the announcement took the nation by surprise, it is evident that this move has been on the PM's agenda since he took oath. The first step was Jan Dhan Yojana. A study of Jan Dhan Yojana will throw up some interesting results on who benefits from demonetization.

1) In 2 years 25 crore bank accounts were opened more in number than the preceding 60 years. The fervor with which accounts were opened seemed odd & the logic of zero balance accounts defied all business rationale(at that time).

2) In September 2014 ~ 75% had zero balances, this was down to 23% as on 9.11.2016, the last update was a day after demonetization which is not a coincidence.

3) In January 2016, every Indian household had one bank account. Direct benefit transfers ensured that households learn how to use these accounts & a further 5 crore accounts were opened after January 2016. These were all second/ third accounts in a household, be it for convenience or subsidy but this was akin to repeat business.

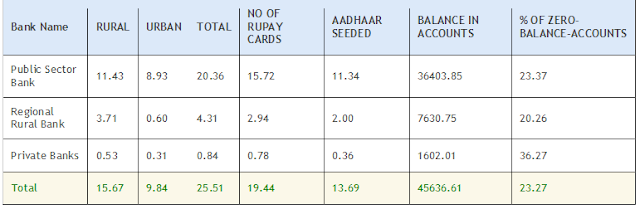

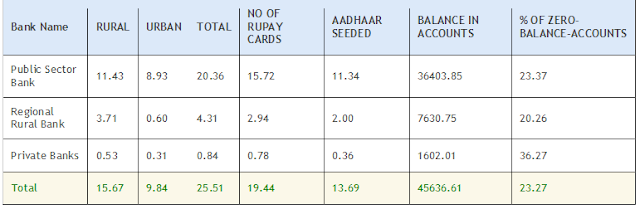

4) The table below shows how banks performed :-

5) The age old fable repeated itself. The rabbit(Pvt sector banks) took it easy & lost out to the tortoise(public sector banks). Pvt sector banks found this nonviable & got a share of just 3% of this business. They cared so little that there share in zero balance accounts was much higher than public sector banks on 9th November 2016. I assure you they have no time presently to correct this.

Banking, infact finance in general is being seen as a technology game. The age old infra by many is considered meaningless. Oddly this move has changed this premise for the time being & the one with branches are miles ahead of others. PSU Banks outnumber private banks 5:1 & have turned out to be the clear winners in this sudden race to deposit.

Till the 16th November, 7 days since announcement SBI has received a net deposit of ~1 Lakh crores. which ~ 20% of the total deposit made into the system. At the end of this exercise SBI alone will be left with a net deposit of 2-3 Lakh crores. At a conservative spread of 3% this will imply 6k-9k crores of annualized boost to profits.

As stated by the MD of Bank of Maharashtra, this is equivalent to making CRR Zero (http://economictimes.indiatimes.com/industry/banking/finance/banking/demonetisation-massive-deposit-bonanza-for-banks-pulls-down-interest-rates/articleshow/55464912.cms). The comparison to CRR is illogical but such has been the inflow of deposits that he does not have the words to express his happiness ! Thanks to Trump the market is still not pricing this in, but PSU banks have been handed a massive LIFELINE.

P.S:- http://www.pmjdy.gov.in/ has details on how banks have individually fared.

This move meant that currency equivalent to 15.4 Lakh Crores would have to be deposited in a bank account. To put the size in context this is equivalent to 11-13% of our GDP. A paltry 3-4 lakh crores will be exchanged/ withdrawn as cash (given the limits imposed), the rest will find its way into one bank or the other, if not RBI/ Govt balance sheet stands to benefit.

While the announcement took the nation by surprise, it is evident that this move has been on the PM's agenda since he took oath. The first step was Jan Dhan Yojana. A study of Jan Dhan Yojana will throw up some interesting results on who benefits from demonetization.

1) In 2 years 25 crore bank accounts were opened more in number than the preceding 60 years. The fervor with which accounts were opened seemed odd & the logic of zero balance accounts defied all business rationale(at that time).

2) In September 2014 ~ 75% had zero balances, this was down to 23% as on 9.11.2016, the last update was a day after demonetization which is not a coincidence.

3) In January 2016, every Indian household had one bank account. Direct benefit transfers ensured that households learn how to use these accounts & a further 5 crore accounts were opened after January 2016. These were all second/ third accounts in a household, be it for convenience or subsidy but this was akin to repeat business.

4) The table below shows how banks performed :-

5) The age old fable repeated itself. The rabbit(Pvt sector banks) took it easy & lost out to the tortoise(public sector banks). Pvt sector banks found this nonviable & got a share of just 3% of this business. They cared so little that there share in zero balance accounts was much higher than public sector banks on 9th November 2016. I assure you they have no time presently to correct this.

Banking, infact finance in general is being seen as a technology game. The age old infra by many is considered meaningless. Oddly this move has changed this premise for the time being & the one with branches are miles ahead of others. PSU Banks outnumber private banks 5:1 & have turned out to be the clear winners in this sudden race to deposit.

Till the 16th November, 7 days since announcement SBI has received a net deposit of ~1 Lakh crores. which ~ 20% of the total deposit made into the system. At the end of this exercise SBI alone will be left with a net deposit of 2-3 Lakh crores. At a conservative spread of 3% this will imply 6k-9k crores of annualized boost to profits.

As stated by the MD of Bank of Maharashtra, this is equivalent to making CRR Zero (http://economictimes.indiatimes.com/industry/banking/finance/banking/demonetisation-massive-deposit-bonanza-for-banks-pulls-down-interest-rates/articleshow/55464912.cms). The comparison to CRR is illogical but such has been the inflow of deposits that he does not have the words to express his happiness ! Thanks to Trump the market is still not pricing this in, but PSU banks have been handed a massive LIFELINE.

P.S:- http://www.pmjdy.gov.in/ has details on how banks have individually fared.

nice analysis...

ReplyDeleteHi Mann,

ReplyDeleteYou have a very interesting blog with a fresh perspective on valuation and investment opportunity.

Would be so kind to take a look at a look at my blog post on Orient Green Power and offer comments. http://investment-thesis.blogspot.in/

Thanks.

RIL up 4% on 1:1 bonus issue; Nifty ends above 9,900, but flat for the week

ReplyDeleteCapitalStars

Good investing doesn't happen accidentally. It is because good investors work at it. One such example is Jeremy Hughes.

ReplyDeleteJeremy Hughes Perth

An attitude of positive expectation is the mark of the superior personality

ReplyDeleteintraday Stock Tips