Management : Keeping the Art in investing alive

Over the years, theorists have worked very hard to make investment as quantitative & objective as possible.

From the 1980's - 2000, Ratios were a focus area. Thus one saw the emergence of many ratios like P/E, P/B, EV/EBITDA, Dividend yield etc. Largely a range was set based on which one would evaluate whether a stock was cheap or expensive. I would probably call this the Ben Graham era of investing, infact Graham combined PE & PB to come up with the Graham number or Graham ratio. As with any quantitative approach, it is quickly replicated & thus investing purely based on these ratios does not yield results.

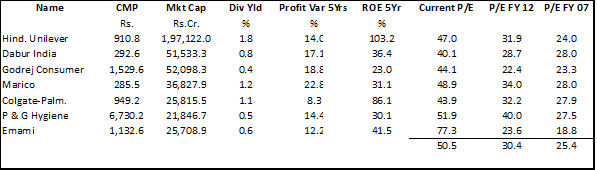

Post 2000 as India started to absorb Warren Buffet's success story & his observations by way of his annual letters were embraced by the investment community, one saw the emergence of buying 'great businesses'. Over the last decade, theorists have managed to quantify these as well based on metrics like ROE, ROCE, Low debt, Negative working capital, Free cash flow etc. The table below shows how valuation has outpaced growth & thus I believe blindly buying great businesses is unlikely to yield great results either.

In an over researched market, qualitative factors become more important towards stock selection & that is why Investing is more an Art than a science. One important qualitative factor is the Management. Zeroing in on the quality of a management & that too early is quite tricky. Even the most seasoned investors can go wrong here.

Let me give you an example, Caplin Point Labs is one of the most successful pharma stories increasing 20x in the last 3 years. A collaborative blog called Valuepickr has been among the earliest to sight & highlight almost every pharma multibagger over the last 5 years. Even this seasoned group of DIY investors(not random analysts) gave a strong thumbs down to the Caplin management & the discussion on their blog got so intense that a few readers who were in support of the company were categorically asked to mellow down as they felt the promoter was bluffing. This is precisely why understanding & judging managements is a great equalizer for an ordinary investor, in the world of data & tech.

I have a small checklist, but if anything it is just the starting point. Infact I have mentioned exceptions to each observation :-

1) Qualification & experience (Mayur Uniquoters)

2) 1st generation/ professionally managed (SRF, Bajaj Auto)

3) Renowned Auditors (Caplin Point)

4) Informative Annual Report (LG Balakrishnan)

5) No doubtful related party transactions (United Spirit)

6) No Competing unlisted companies (P&G, Monsanto)

Judging managements involves intense reading, comparisons & interactions (if possible).

A case in point is a recent investment, Torrent Power. The company ticks every box so one was compelled to delve deeper. These observations cemented my initial premise :-

=> My experience with the Pharma arm was exceptional & I was very impressed to see Mr. Sudhir Mehta hand over the reigns of the pharma business to his younger brother Samir. A smooth & quiet transition. While there has been no split till date yet the step ensures that personal conflicts are unlikely. This also implies that Sudhir's focus will be on Power which he Chairs.

=> The company recovered 15% of the project cost in Dahej from a vendor like Siemens, on account of delay. This was not a court fight more a negotiation with regards to the terms. A management that has the ability to track its terms & ensure that fine print does not allow a company like Siemens to get away is extremely rare. Company has banked a ~750 crore recovery on a project costing more than 5000 crores. This ensured that the costs remained as budgeted.

=> The management was the 1st to lay pipelines directly connecting its plants to the Petronet Gas terminal. This was done when imported gas was three times as costly as domestic, showing foresight both towards the availability & eventually correction of the commodity. They were among the first to exclusively book space for Gas at Petronent's expanded terminal & will reap the benefits now as the expanded terminal got commissioned this month.

=> Power distribution is often considered a business for the politically connected. Most players are deemed to have a local edge & thus expansion is limited. Torrent has managed success not just in its home turf Gujarat where it has the municipalities of Ahmedabad, Gandhinagar, Surat & Dahej but also Bhiwandi in Maharashtra, Agra & Kanpur in UP. The company has set a benchmark which the link below highlights. http://www.business-standard.com/article/economy-policy/rajasthan-to-emulate-famous-bhiwandi-power-reforms-model-116022300201_1.html

May the Management be with you (legally) !

From the 1980's - 2000, Ratios were a focus area. Thus one saw the emergence of many ratios like P/E, P/B, EV/EBITDA, Dividend yield etc. Largely a range was set based on which one would evaluate whether a stock was cheap or expensive. I would probably call this the Ben Graham era of investing, infact Graham combined PE & PB to come up with the Graham number or Graham ratio. As with any quantitative approach, it is quickly replicated & thus investing purely based on these ratios does not yield results.

Post 2000 as India started to absorb Warren Buffet's success story & his observations by way of his annual letters were embraced by the investment community, one saw the emergence of buying 'great businesses'. Over the last decade, theorists have managed to quantify these as well based on metrics like ROE, ROCE, Low debt, Negative working capital, Free cash flow etc. The table below shows how valuation has outpaced growth & thus I believe blindly buying great businesses is unlikely to yield great results either.

In an over researched market, qualitative factors become more important towards stock selection & that is why Investing is more an Art than a science. One important qualitative factor is the Management. Zeroing in on the quality of a management & that too early is quite tricky. Even the most seasoned investors can go wrong here.

Let me give you an example, Caplin Point Labs is one of the most successful pharma stories increasing 20x in the last 3 years. A collaborative blog called Valuepickr has been among the earliest to sight & highlight almost every pharma multibagger over the last 5 years. Even this seasoned group of DIY investors(not random analysts) gave a strong thumbs down to the Caplin management & the discussion on their blog got so intense that a few readers who were in support of the company were categorically asked to mellow down as they felt the promoter was bluffing. This is precisely why understanding & judging managements is a great equalizer for an ordinary investor, in the world of data & tech.

I have a small checklist, but if anything it is just the starting point. Infact I have mentioned exceptions to each observation :-

1) Qualification & experience (Mayur Uniquoters)

2) 1st generation/ professionally managed (SRF, Bajaj Auto)

3) Renowned Auditors (Caplin Point)

4) Informative Annual Report (LG Balakrishnan)

5) No doubtful related party transactions (United Spirit)

6) No Competing unlisted companies (P&G, Monsanto)

Judging managements involves intense reading, comparisons & interactions (if possible).

A case in point is a recent investment, Torrent Power. The company ticks every box so one was compelled to delve deeper. These observations cemented my initial premise :-

=> My experience with the Pharma arm was exceptional & I was very impressed to see Mr. Sudhir Mehta hand over the reigns of the pharma business to his younger brother Samir. A smooth & quiet transition. While there has been no split till date yet the step ensures that personal conflicts are unlikely. This also implies that Sudhir's focus will be on Power which he Chairs.

=> The company recovered 15% of the project cost in Dahej from a vendor like Siemens, on account of delay. This was not a court fight more a negotiation with regards to the terms. A management that has the ability to track its terms & ensure that fine print does not allow a company like Siemens to get away is extremely rare. Company has banked a ~750 crore recovery on a project costing more than 5000 crores. This ensured that the costs remained as budgeted.

=> The management was the 1st to lay pipelines directly connecting its plants to the Petronet Gas terminal. This was done when imported gas was three times as costly as domestic, showing foresight both towards the availability & eventually correction of the commodity. They were among the first to exclusively book space for Gas at Petronent's expanded terminal & will reap the benefits now as the expanded terminal got commissioned this month.

=> Power distribution is often considered a business for the politically connected. Most players are deemed to have a local edge & thus expansion is limited. Torrent has managed success not just in its home turf Gujarat where it has the municipalities of Ahmedabad, Gandhinagar, Surat & Dahej but also Bhiwandi in Maharashtra, Agra & Kanpur in UP. The company has set a benchmark which the link below highlights. http://www.business-standard.com/article/economy-policy/rajasthan-to-emulate-famous-bhiwandi-power-reforms-model-116022300201_1.html

May the Management be with you (legally) !

Good Analysis sir , i want to invest for long term like 10 year horizon so can i invest above stock for that plz suggest it. Goal is Child Education,Marriage ,Retirement. I have some stocks identified so plz suggests for the stock Virat Ind @ 84, Gulf Petro @ 57, JHS Svend Lab @ 36, Cupid @ 300, Intellect @ 190,Eastern Trades @ 165, Max Venture @ 57, Wonderla @ 408, KTK bank @ 150, NBCC @ 240,

ReplyDeleteThanks Gaurang. I have not done any detailed work on the names mentioned.

ReplyDeleteHi Maan, I liked your analysis very much. Thanks for it. I would like to buy it. Most often the difficult part is when to sell..Can you also provide a call on when to exit the above stock in future??

ReplyDeleteArun - I am glad you liked it. As far as buying is concerned, I would urge you to do your own homework as this article was more around the process & the example of Torrent fitted with the context.

ReplyDeleteMy basic premise on Torrent is based on the fact that it has completed a heavy capex with a strong/sheet, thus operational leverage will kick in soon. I will exit when it embarks upon another large capex or the operational leverage starts reflecting in the earnings. Your question has given me some fodder on which I can base my next blog, Thanks.

thanx for the reply Maan. I got what i was looking for: the signals for when to exit this.

DeleteHi Mann, What are your views on JSW Energy? It also seems to have very competent management and promoters. They were judicious to not expand when everyone else was doing it and are not are getting some really good deals at below replacement costs.

ReplyDeleteThanks.

Hi - I have not looked at JSW in great detail but in this space I feel distribution is a better business than generation. As far as acquisitions go, I dont think their balance sheet permits anything adventurous.

DeleteHi, What are you reasons for liking distribution over generation.

DeleteIt seems like the new UDAY scheme will force a few states to try private distribution, so there is an upside, but does the regulated nature of the distribution business not limit the returns? Also, populist governments in some states (e.g. Delhi govt ordering a review of books of discoms and CESC not getting tariff order revisions in time in Kolkata) will lead to an ever-present uncertainty in the business, which might not let markets value them very high.

Generation has its downsides, but it seems like it is at bottom of the cycle. There is excess capacity in the system, merchant power prices are at historic lows and discoms are not signing new PPAs. But these are cyclical factors and as demand picks up greater utilization should enable greater returns.

Your thoughts?

• Tata Metaliks Limited net zooms 54%

ReplyDelete• Gold prices slip on stronger dollar

Currency Tips

Forex trading tips

i read a lot of stuff and i found that the way of writing to clearifing that exactly want to say was very good so i am impressed and ilike to come again in future..

ReplyDeletechart

Your Blog Is Full Of Knowledge... Thanks For Sharing you are providing really very good information which is helpful for all great work.

ReplyDeleteFree Trial